(Image source from: Businesstoday.in)

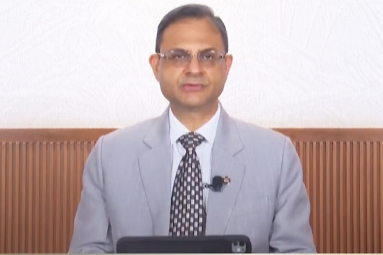

RBI Governor Shaktikanta Das recently proposed new ways to deposit cash and make payments through UPI. Instead of relying solely on debit cards, cash can now be deposited in cash deposit machines using UPI. This change is based on the success of cardless cash withdrawal using UPI at ATMs. By allowing this method, customer convenience will be improved and currency handling at banks will become more efficient. Additionally, Governor Das announced that payments through PPI wallets can now be made using third-party UPI apps. Currently, UPI payments from PPIs can only be made through the issuer's web or mobile app. However, with this proposal, customers will have the option to use other UPI apps for making payments from PPI wallets. This change is expected to enhance customer convenience and encourage the use of digital payments for small transactions.

The CEO of Bankbazaar.com expressed that allowing the linking of prepaid payment instruments (PPIs) through third-party UPI apps will provide more flexibility for PPI holders. This change will enable PPI holders to make UPI payments in a similar manner to bank account holders, which is a significant step forward in improving accessibility to digital payments. This development allows individuals who use digital wallets and other prepaid payment instruments to seamlessly utilize UPI services through any third-party app. This strategic shift removes the previous reliance on the PPI issuer for UPI transactions, giving individuals the freedom to use a variety of third-party apps for UPI-enabled transactions. This will streamline payment processes and promote financial inclusivity within India's digital ecosystem.