Indian Union Budget 2016 by Arun Jaitley – Pro-poor, growth oriented

February 29, 2016 15:15

(Image source from: Indian Union Budget 2016 by Arun Jaitley – Pro-poor)

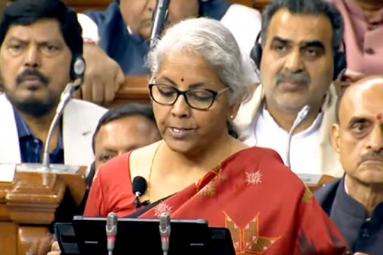

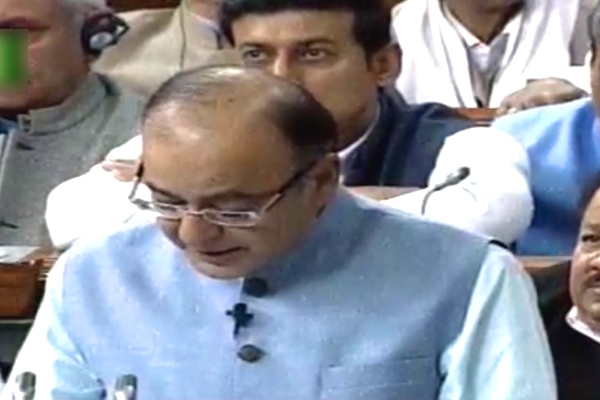

Finance Minister Arun Jaitley unveiled a budget for farmers and the poor on today, announcing a string of farm measures, rural aid and health programs. He has also announced measures that would help more than two crore taxpayers. Investors are relieved that the government is sticking to the roadmap for fiscal consolidation.

"We need to give back to our farmers. We need to think beyond food security to income security, will double income of farmers by 2022." He has allocated Rs. 35,984 crore for farmers' welfare. Among major announcements was one for LPG connections for poor women.

"We inherited an economy of slow growth, high inflation and low faith in government, amidst global headwinds, the Indian economy has held its own," said Mr Jaitley.

Highlights of the Budget 2016:

Allocation for Agriculture and Farmers’ welfare is ` 35,984 crore

Pradhan Mantri Krishi Sinchai Yojana’ to be implemented in mission mode. 28.5 lakh hectares will be brought under irrigation.

Implementation of 89 irrigation projects under AIBP, which are languishing for a long time, will be fast tracked.

A dedicated Long Term Irrigation Fund will be created in NABARD with an initial corpus of about ` 20,000 crore

2.87 lakh crore will be given as Grant in Aid to Gram Panchayats and Municipalities as per the recommendations of the 14th Finance Commission

Every block under drought and rural distress will be taken up as an intensive Block under the Deen Dayal Antyodaya Mission

A sum of ` 38,500 crore allocated for MGNREGS.

Allocation for social sector including education and health care – 1,51,581 crore.

2,000 crore allocated for initial cost of providing LPG connections to BPL families.

‘National Dialysis Services Programme’ to be started under National Health Mission through PPP mode

GoI will pay contribution of 8.33% for of all new employees enrolling in EPFO for the first three years of their employment. Budget provision of 1000 crore for this scheme.

Raise the ceiling of tax rebate under section 87A from 2000 to 5000 to lessen tax burden on individuals with income upto 5 lakhs.

Increase the limit of deduction of rent paid under section 80GG from `24000 per annum to `60000, to provide relief to those who live in rented houses.

Changes in customs and excise duty rates on certain inputs to reduce costs and improve competitiveness of domestic industry in sectors like Information technology hardware, capital goods, defence production, textiles, mineral fuels & mineral oils, chemicals & petrochemicals, paper, paperboard & newsprint, Maintenance repair and overhauling [MRO] of aircrafts and ship repair.Withdrawal up to 40% of the corpus at the time of retirement to be tax exempt in the case of National Pension Scheme (NPS). Annuity fund which goes to legal heir will not be taxable.

Domestic taxpayers can declare undisclosed income or such income represented in the form of any asset by paying tax at 30%, and surcharge at 7.5% and penalty at 7.5%, which is a total of 45% of the undisclosed income. Declarants will have immunity from prosecution.

By Premji